south dakota vehicle sales tax exemption

United States government agencies State of South Dakota Indian tribes. Many states have special lowered sales tax rates for certain.

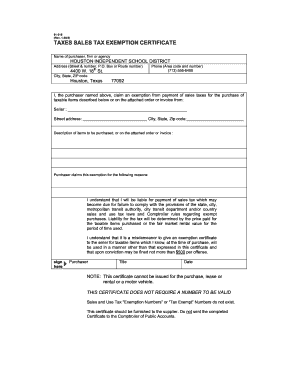

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Cars Trucks Vans South Dakota Department Of Revenue SDL 32-5-2 are also exempt from sales tax.

. 32-5B-13 Licensing and titling of used vehicle by dealer. 2021 south dakota state sales tax. 84-Insurance company titles vehicleboat and does not pay 4 excise tax.

SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. Public schools including K-12 universities and technical institutes that are supported by the State of South Dakota or. If you rent or lease a.

For example if you pay 30000 for a new car but trade in your old one thats valued at 4000 your sales tax will only be applied to the 26000 price. Plates are not removed from vehicle08 92-House trailer subject to 4 initial registration fee upon initial registration09 94-ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax. South Dakota Title Number _____ Odometer Reading is_____which is actual vehicle.

Prior to July 1 1990 out-of-state vehicle titled and taxed in the corporate name of a licensed. Selling a Vehicle in South Dakota. 13 rows In South Dakota certain items may be exempt from the sales tax to all consumers not just.

While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation. 1be an enrolled member of a federally recognized Indian tribe. If the purchase is subject to a contract existing between the buyer and seller the exemption is taken at the POP regardless of the amount.

This includes the following see. South Dakota is subject to sales or use tax. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

In South Dakota the sales and use tax rate is 45. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. If the purchase is less than 1000 the exemption is made by claiming a refund from the Tax Commission.

The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45. The product or service is specifically exempt from sales tax. You can find these fees further down on the page.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. List SD Sales Tax Number_____ 27. The vehicle is exempt from motor vehicle excise under SDCL 32-5B-2.

1151 in South Dakota that is governed by. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Are NOT exempt from South Dakota sales or use tax.

The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2. The laws applicable in South Dakota allow a business person to include sales tax on the price of the products or services they offer. This form is to be used when claiming an exemption from the South Dakota excise tax on a South Dakota titled vehicleboat.

Different areas have varying additional sales taxes as well. All car sales in South Dakota are subject to the 4 statewide sales tax. For vehicles that are being rented or leased see see taxation of leases and rentals.

In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Motor vehicles exempt from the motor vehicle excise tax under. 32-5B-12 Leasing or rental company separate from dealership--Distinct name--Daily rental operations--Exemption from excise tax.

Several examples of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. However should there be sales tax due the seller becomes fully liable whether the sales tax was collected or not. The purchaser is a tax exempt entity.

AND 2reside on Indian country as defined by 18 USC. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Not all states allow all exemptions listed on this form.

Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32-5-27. This is the case even when the buyers out-of-pocket cost for the purchase is 10800. All brand-new vehicles are charged a 4 excise tax in the state of South.

Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must. The average sales tax rate on vehicles across the state is. In other words be sure to subtract the trade-in amount from the car price before calculating sales tax.

SDL 32-5-2 are also exempt from sales tax. Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must. Mobile manufactured homes are subject to the 4 initial registration fee.

AND 2reside on Indian country as defined by 18 USC. This includes the following see SDCL 32-5B-2 for a complete list. Exemption from excise tax for motor vehicles leased to tax exempt entities.

However the buyer will have to pay taxes on the car as if its total cost is 12000. 95-A title only is issued when the applicant does not purchase. Subject to either sales or use tax or motor vehicle excise tax unless exempt under SDCL 32-5B-2.

The exempt entity must pay the vendor directly from the exempt entitys funds. The range of total sales tax rates within the state of South Dakota is between 4 and 65. Motor vehicles exempt from the motor vehicle excise tax under SDCL 32-5B-2 are also exempt from sales tax.

Car sales tax does not apply to trade-in vehicles in South Dakota. Purchasers are responsible for knowing if they qualify to claim exemption from tax in. Need to complete a Sales Tax Exemption Application TC-160 to receive an exempt certificate.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. If i paid excise tax on a new vehicle in south dakota can i claim that as sales tax. State of South Dakota and public or municipal corporations of the State of South Dakota.

32-5B-11 Licensing and payment of tax on leased vehicles--Assessment of tax upon purchase by lessee--Lessor to assign title and certify price fees and title. This is a multi-state form. Employee Purchases - The exemption from sales and use tax for the above agencies does not extend to the purchase of products or services for the personal use of officials members or employees of such institutions.

South dakota collects a 4 state sales tax rate on the purchase of all vehicles. It is a compulsory requirement for a. The purchaser submits a claim for exemption.

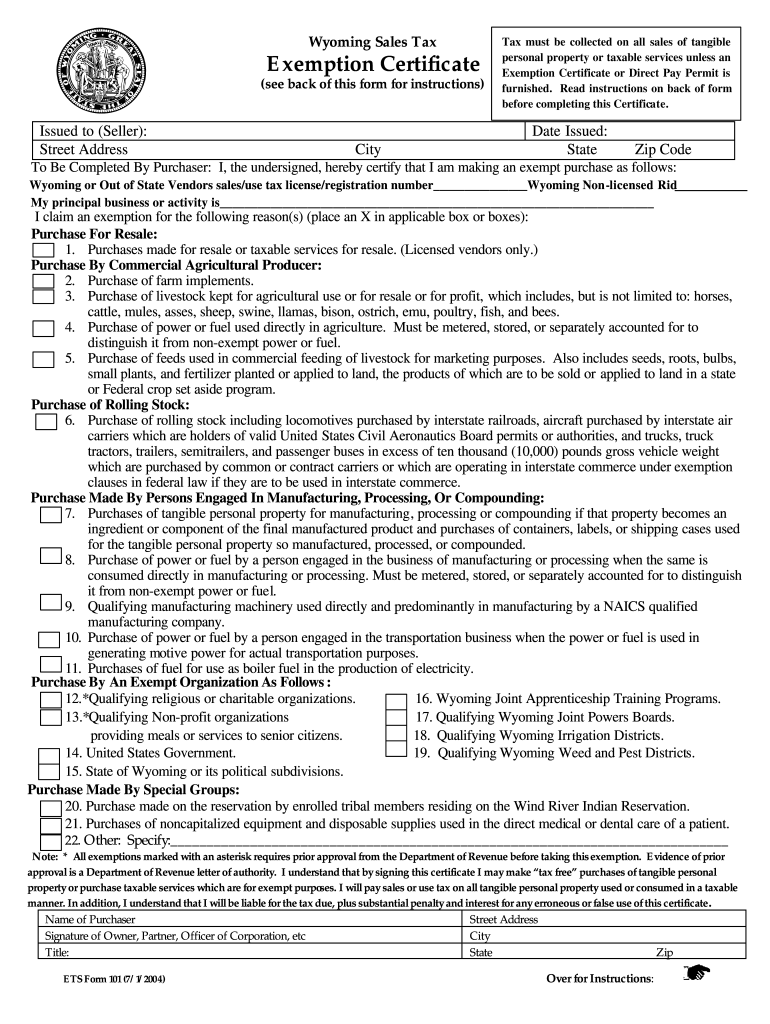

2004 2022 Form Wy Ets 101 Fill Online Printable Fillable Blank Pdffiller

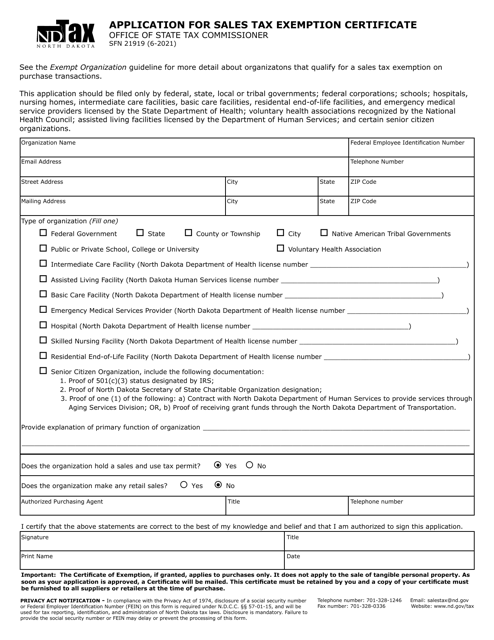

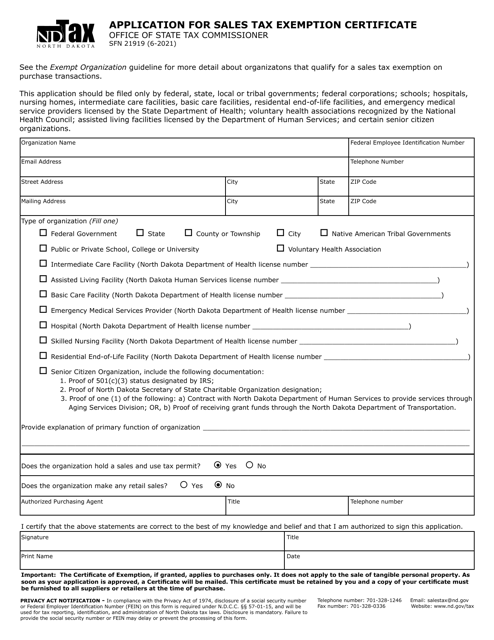

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

South Dakota Sales Tax Small Business Guide Truic

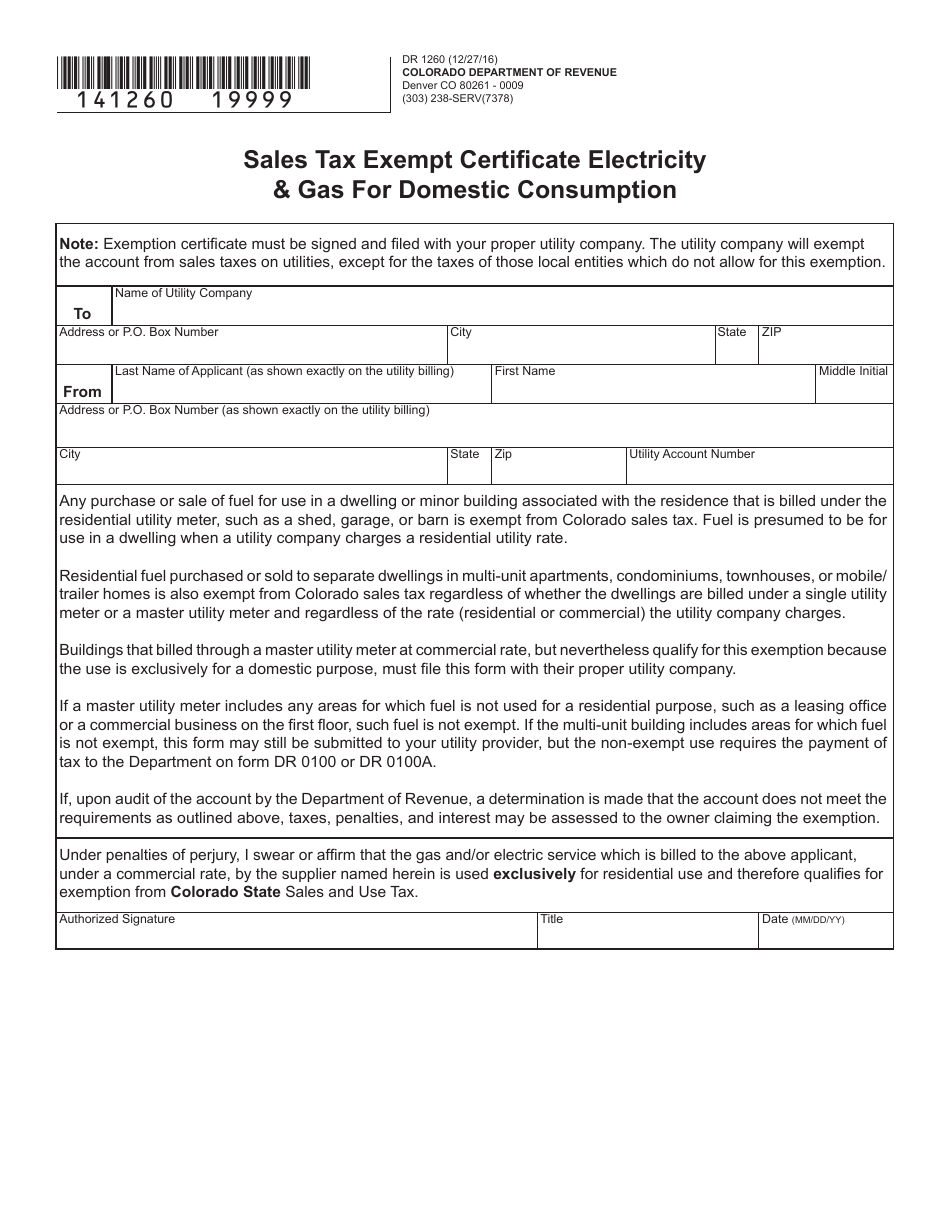

Form Dr1260 Download Printable Pdf Or Fill Online Sales Tax Exempt Certificate Electricity Gas For Domestic Consumption Colorado Templateroller

Printable Washington Sales Tax Exemption Certificates

Sales And Use Tax Regulations Article 11

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

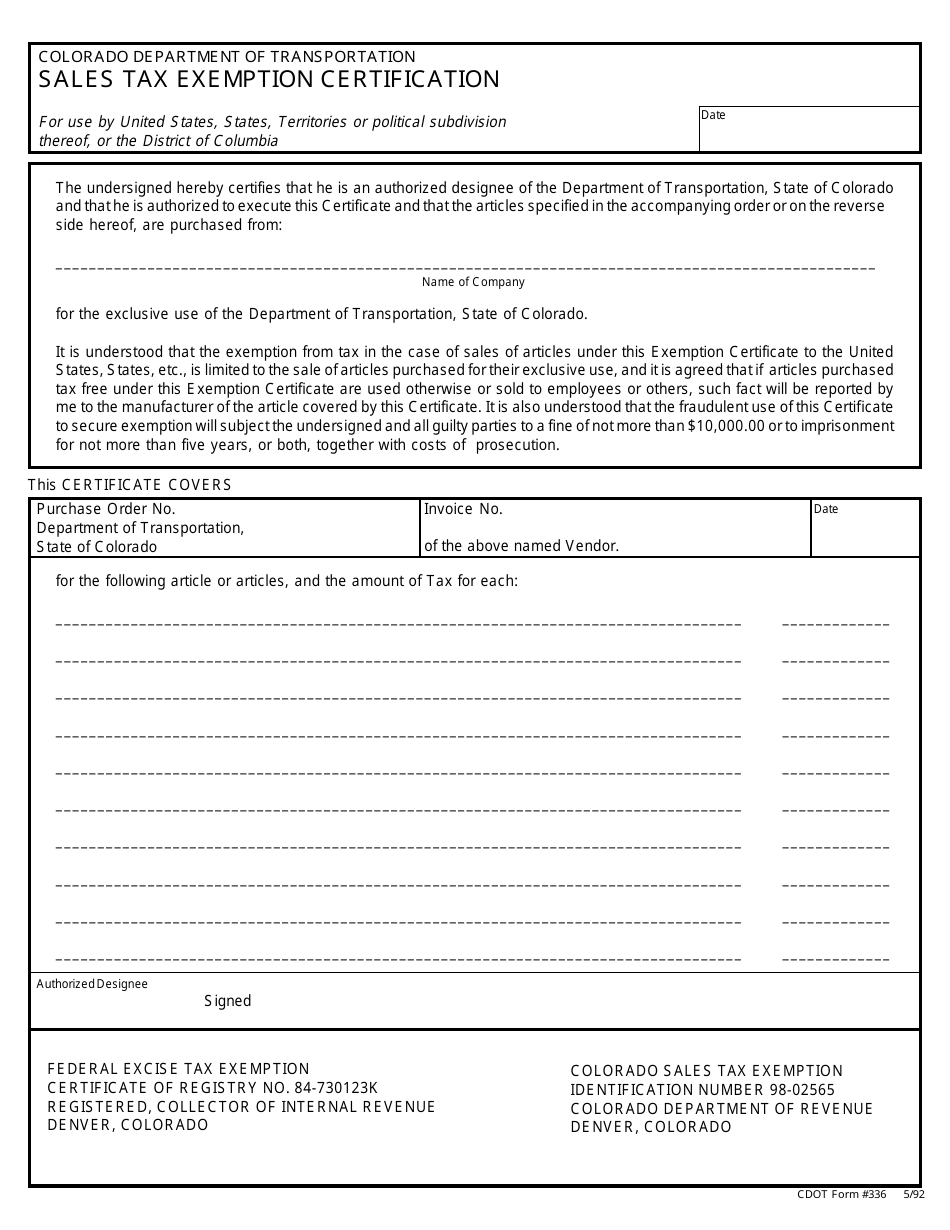

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

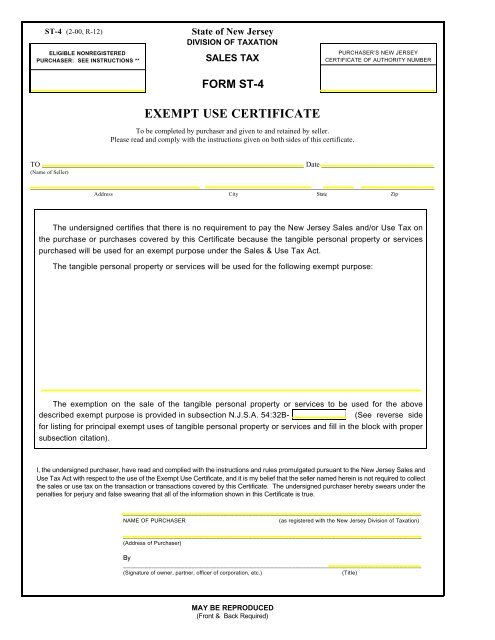

St 4 Sales Tax Exempt Use Certificate Mcnichols Company

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

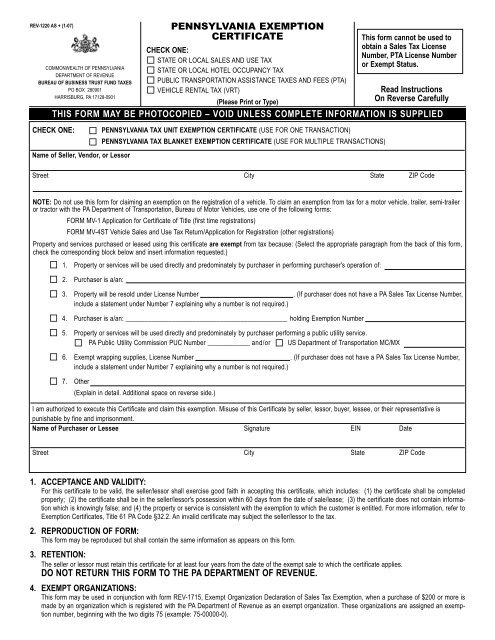

Pa Tax Exemption Certificate Quality Computer Services

Fillable Online Www3 Mdanderson Attachment I Sales Tax Exemption Certificate Md Anderson Cancer Www3 Mdanderson Fax Email Print Pdffiller

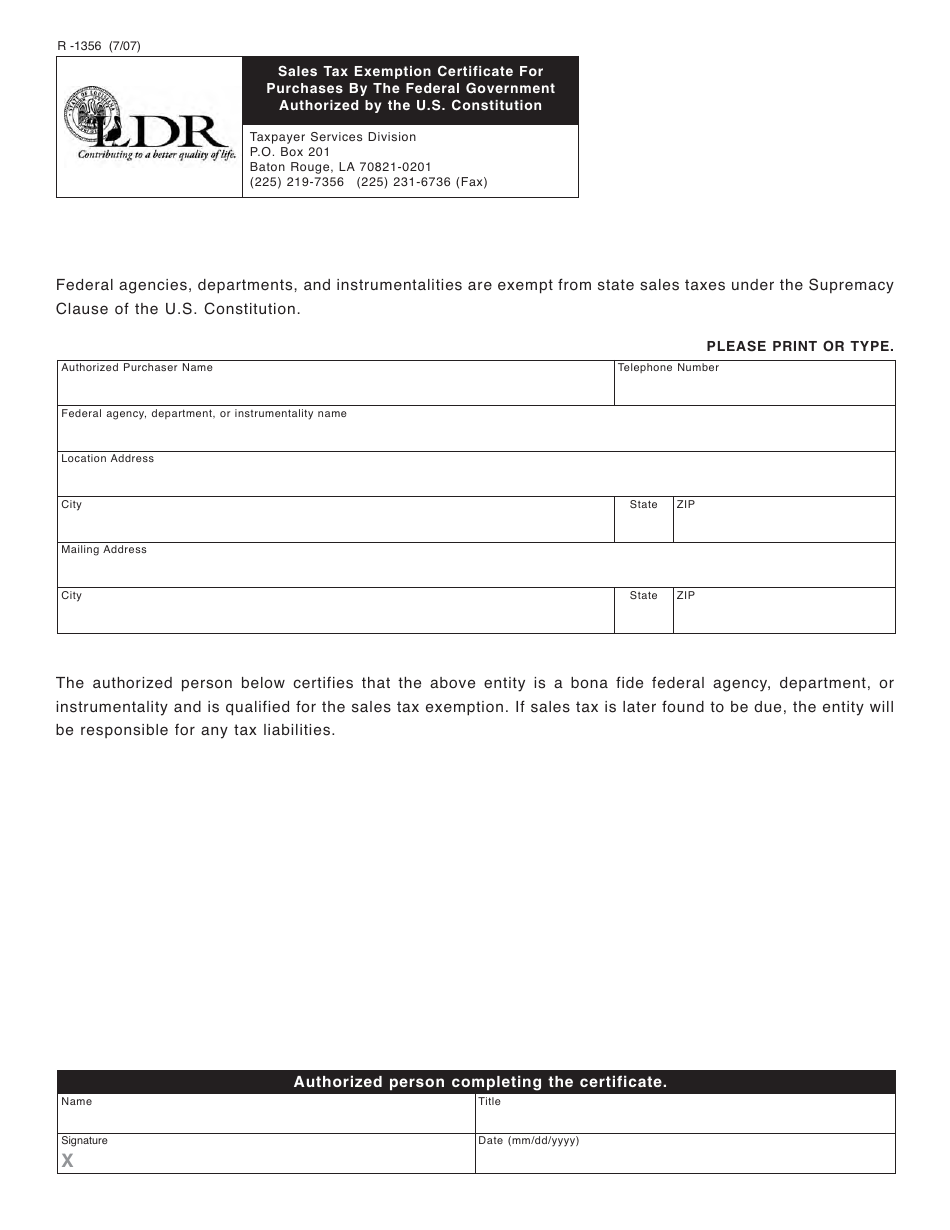

Form R 1356 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases By The Federal Government Authorized By The U S Constitution Louisiana Templateroller

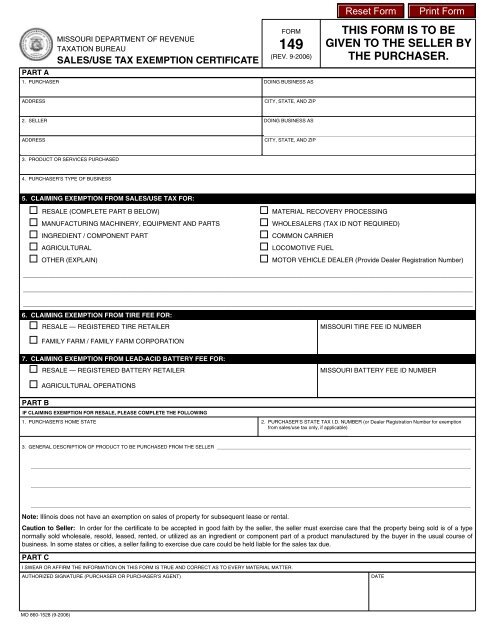

149 Sales Use Tax Exemption Certificate

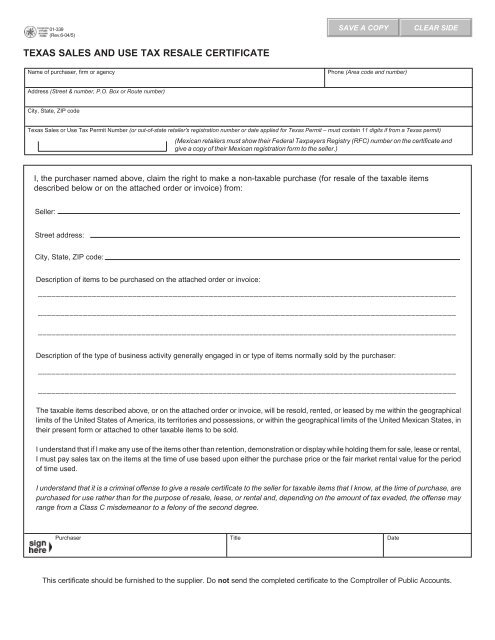

Texas Sales And Use Tax Exemption Certificate

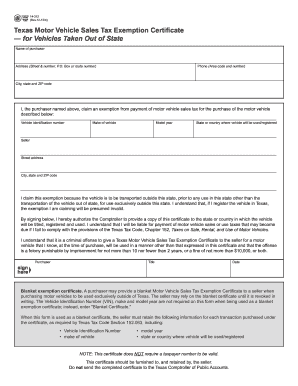

Texas Motor Vehicle Tax Fill Out And Sign Printable Pdf Template Signnow

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com